An industry ripe for the platform economy

“Covid has given us a 10-year leap forward in terms of digital usage”, says Stéphanie Bigeon Bienvenu, Director of Communication and Transformation at OPPBTP. For the construction industry, historically averse to digital transformations, this is a real leap forward. Like in other sectors, remote collaboration tools have helped people to keep working effectively. According to McKinsey, BIM, 4D, 5D, or digital twin solutions (see Side A) have benefited from the pandemic by allowing teams to continue design or maintenance activities partially and remotely. In a BIM Project study, 61% of professionals in the construction industry state that the use of digital tools has become essential after the pandemic. These tools allow skills, business tools, and project data to be brought together in the same virtual space and facilitate meetings between solution providers and builders. Everyone knows what defines platforms, these “contemporary services of algorithms, matching information, relations, goods, and services”, says Engineer School Telecom Paris sociology professor Antonio Casilli.

Beyond the pandemic, the platforms provide answers to historical challenges in the construction industry. Techcrunch has identified four main challenges: the fragmentation of expertise, which slows down projects; poor communication, which costs $31 billion a year in mistakes made on-site in the United States alone; lack of information transparency; and finally, the difficulty in finding a qualified workforce. For Finalcad, a French pioneer in the sector, this new range of tools gives the construction industry the opportunity to improve its historically low margins (around 2%). Faced with this mouth-watering promise, investments have followed: these have more than doubled in less than 10 years in ConTechs.

A growing landscape

What solutions do the platforms provide? How does the competition work? The Construction Tech landscape is still in a state of flux, but large families of tools are emerging. In its Top50, Cemex Ventures has identified four categories:

- Security & Sustainability, with startups like Viact, which provides automated site supervision based on AI, IoT, and 5G technologies.

- Supply Chains, as seen with Voyage Control, which has developed a logistics management platform for construction sites.

- Productivity, bringing together tools such as Archdesk, an integrated site management platform. It handles project management (process, production control, and schedules), on-site finance (such as invoicing and budgets) but also deals with observation reports, HR, CRM, and even stock management.

- New materials and new construction methods, where start-ups are shaking up traditional know-how. Mighty Buildings, for instance, provide 3D printing technology for the construction industry.

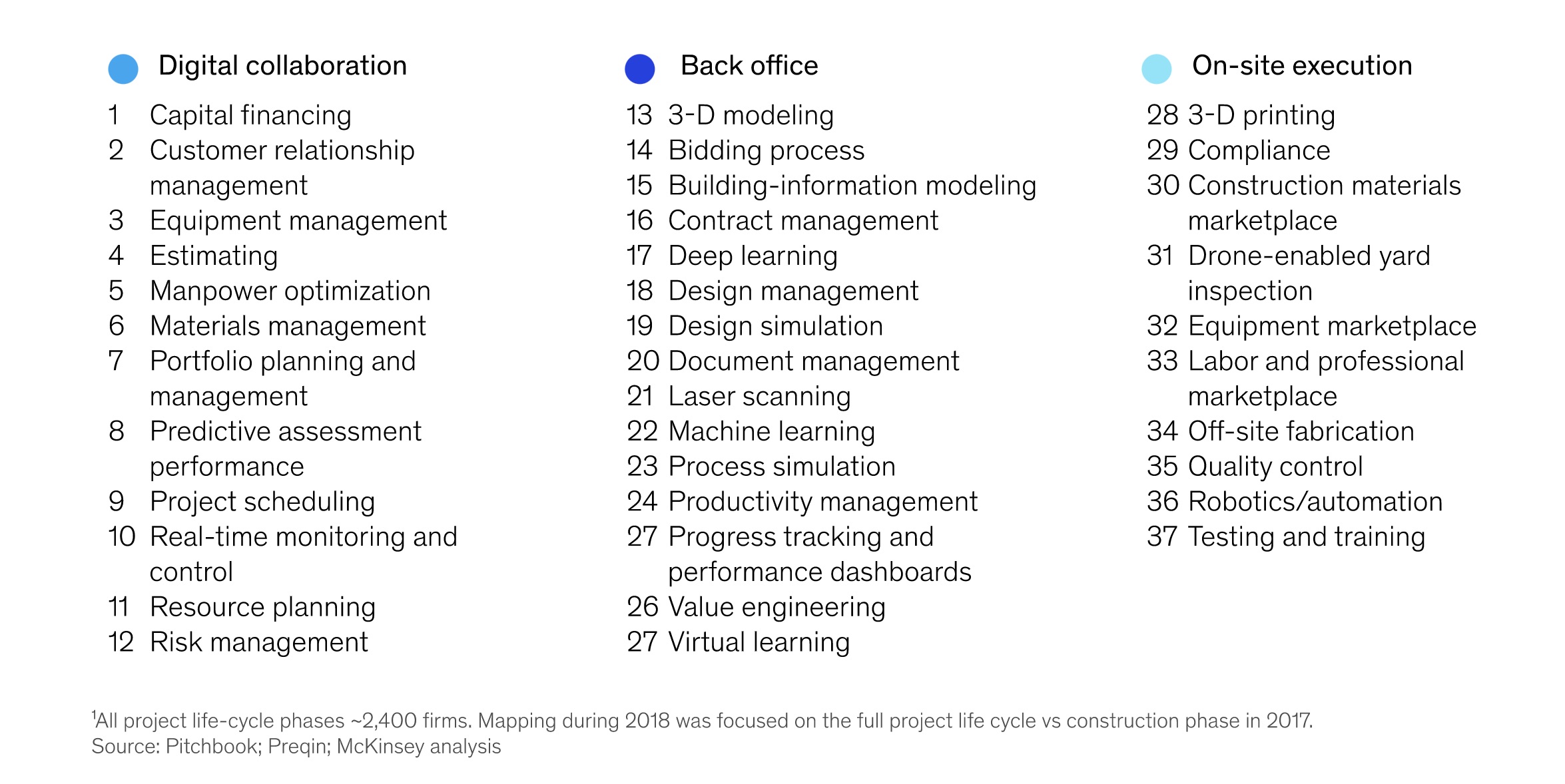

McKinsey’s mapping goes into further detail and has identified 37 aspects divided into 3 main categories: digital collaboration, back-office, and on-site operations.

According to the Institute, the most promising use cases fall into four clusters: supply chain and procurement, optimisation and marketplace; artificial intelligence and data analysis; 3-D printing, modularity and robotics; and digital twin technology.

Although it is not easy to identify the leaders in the industry, a close follow-up of fundraising gives a good idea of who the main players are. “Unicorn” Procore offers a site management platform and “Unicorn” Katerra supplies a platform bringing together architects and workers to provide modular and standardised construction solutions. In India, infra.market was recently awarded unicorn status after raising $100m in funding. The company is developing solutions aimed at materials logistics. Meanwhile, the sector’s historical leader, Autodesk, is playing a major part in Construction Tech with an aggressive acquisition strategy. The acquisition of PlanGrid in 2019 for $875 million is a case in point.

A time for maturity

Although the landscape is still fragmented, the next few years should see a consolidation of the market, with the emergence of undisputed leaders. In France, the merger between Sogelink, which offers support software solutions for the building industry, and Géodesial, a geomatic engineering champion, shows the trend towards strategic mergers.

In terms of business, Construction Tech players still have to overcome some obstacles. A study published by Procore and the IMF highlights the main criticisms associated with construction technologies. The top three are getting teams to implement solutions (34%), operating problems (17%), and the lack of compatibility between platforms (16%). In most cases, performance is not the issue, but “cultural” adaptation seems more problematic. It might be time for the Construction Tech players to see themselves not as service providers, but as technology partners who can support their customers on a daily basis. In other words, they shouldn’t see the platform model as a neutral medium bringing together needs and responses to those needs, but rather as a device to inspire and drive action strategies.