The investment fund A/O PropTech just published a report on trends in the low-carbon construction technology sector. Othmane Zrikem and Catriona Hyland, respectively Chief Data Officer and Research Analyst at the fund, tell Leonard about the main findings of this study.

Could you introduce the A/O PropTech fund to us?

A/O is a Seed to Series B venture capital fund based in London and investing in built-world startups across Europe and North America. We are a built-world VC fund with a core focus on digitising and decarbonising existing real estate assets and new construction – around two-thirds of our portfolio directly target ESG themes.

What will move your sector in the next few years?

We see significant repricings in the real estate sector due to climate transition risk (i.e., regulatory pressure) and changing tenant demands for greener spaces. Decarbonisation is no longer a nice thing to have – without action, there is a significant risk of buildings becoming stranded assets.

What are the trends in contech that you see as the most promising to meet these challenges?

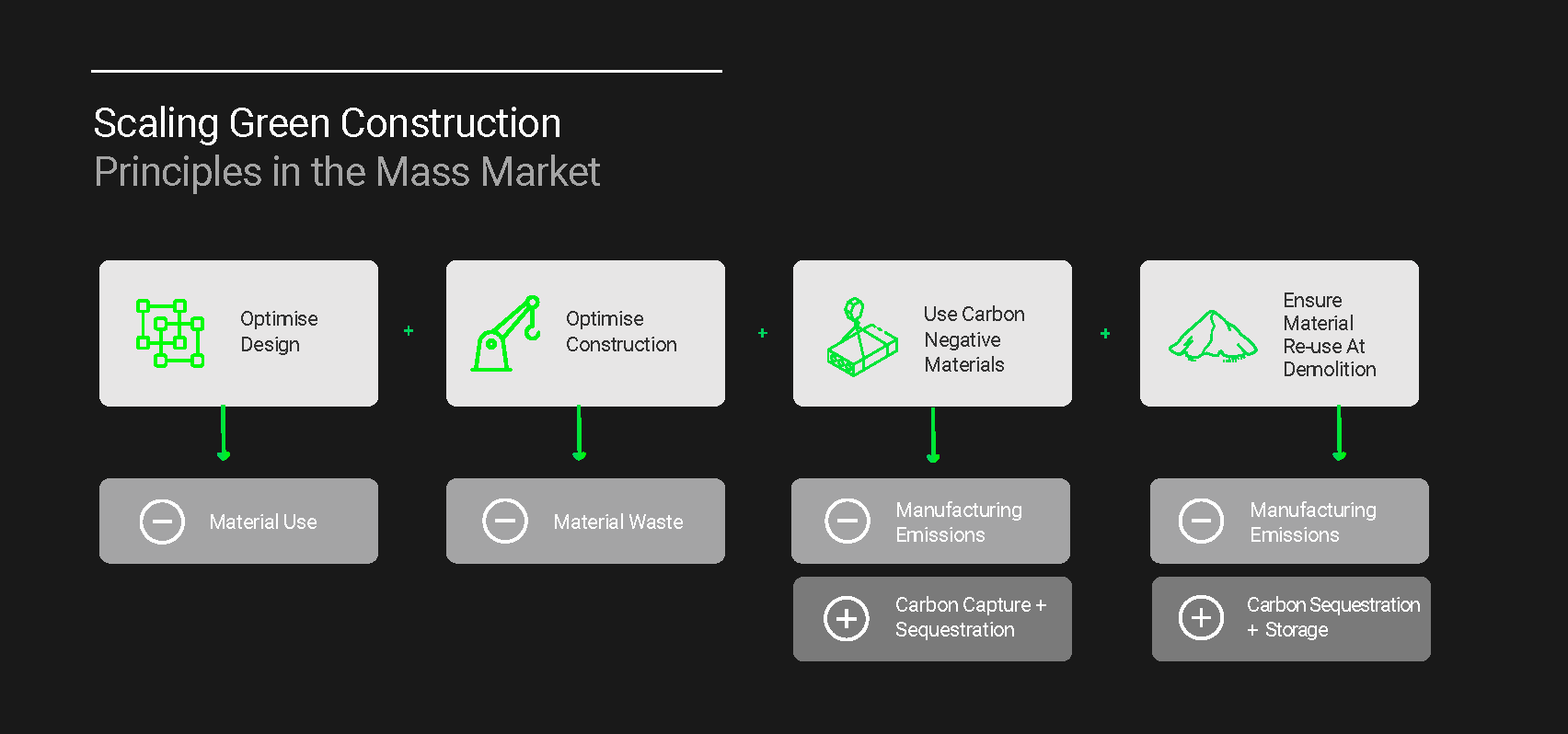

Across the wider construction technology sector, we see key themes of workflow digitisation, construction automation and collaboration tools. There are applications of these themes both onsite (during the construction process) and offsite (during design, engineering, and project management workflows). The low-carbon construction material segment is also expanding with more climate-conscious materials being developed.

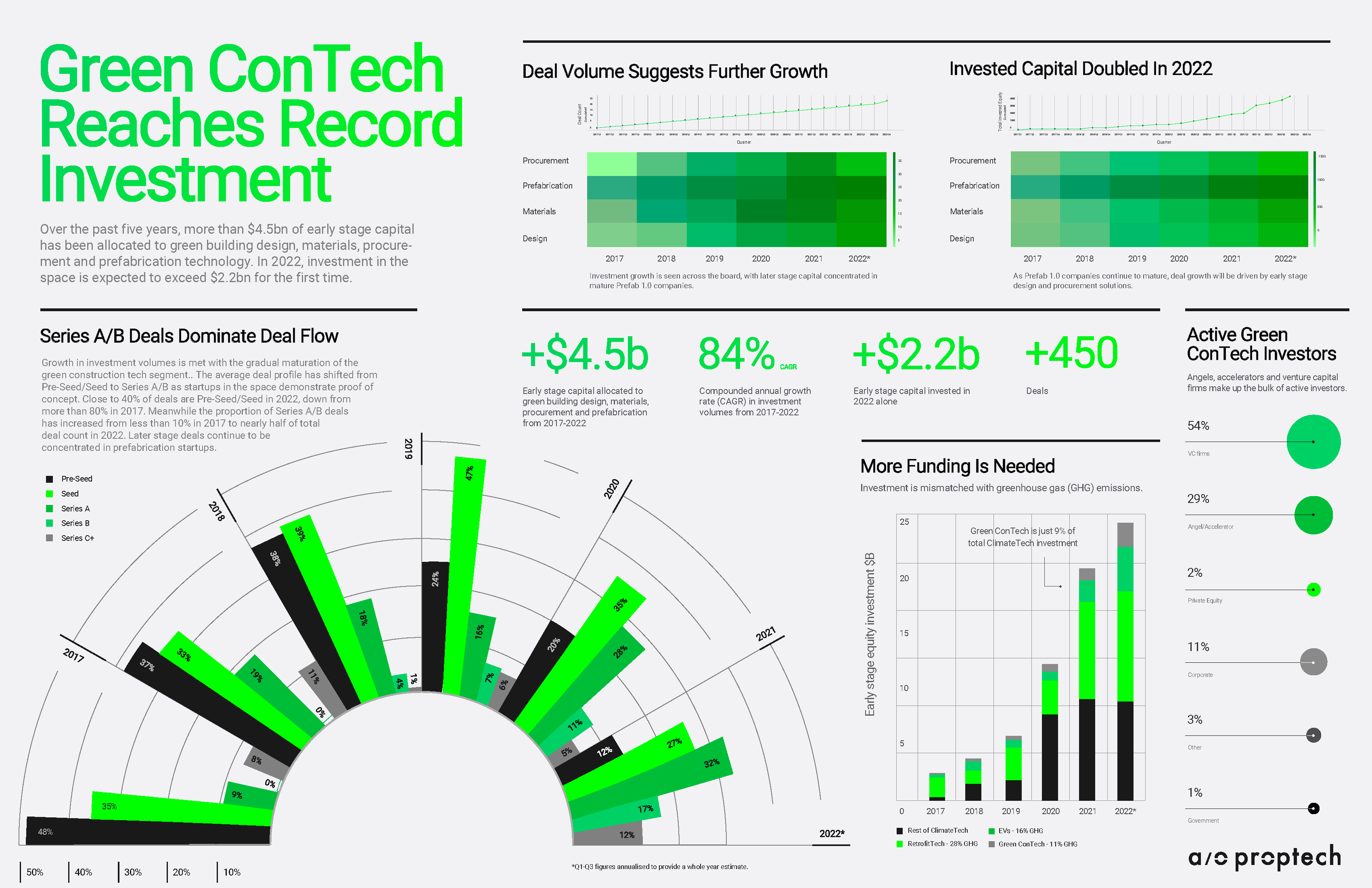

How are investments in the contech sector evolving? Are they suffering from the current investment crisis some other sectors encounter?

Regarding green construction solutions, 2022 has been a record year for venture investment. More than $2.2B has been invested by VCs in US and European startups this year – this is particularly significant given funding in the space over the past five years has totalled $4.5B. Historically venture funding has been concentrated in prefabrication startups. We are now seeing a growing wave of investment into next-generation design and procurement solutions that not only improve workflow efficiency, but also empower architects and developers to proactively reduce carbon emissions in new developments.

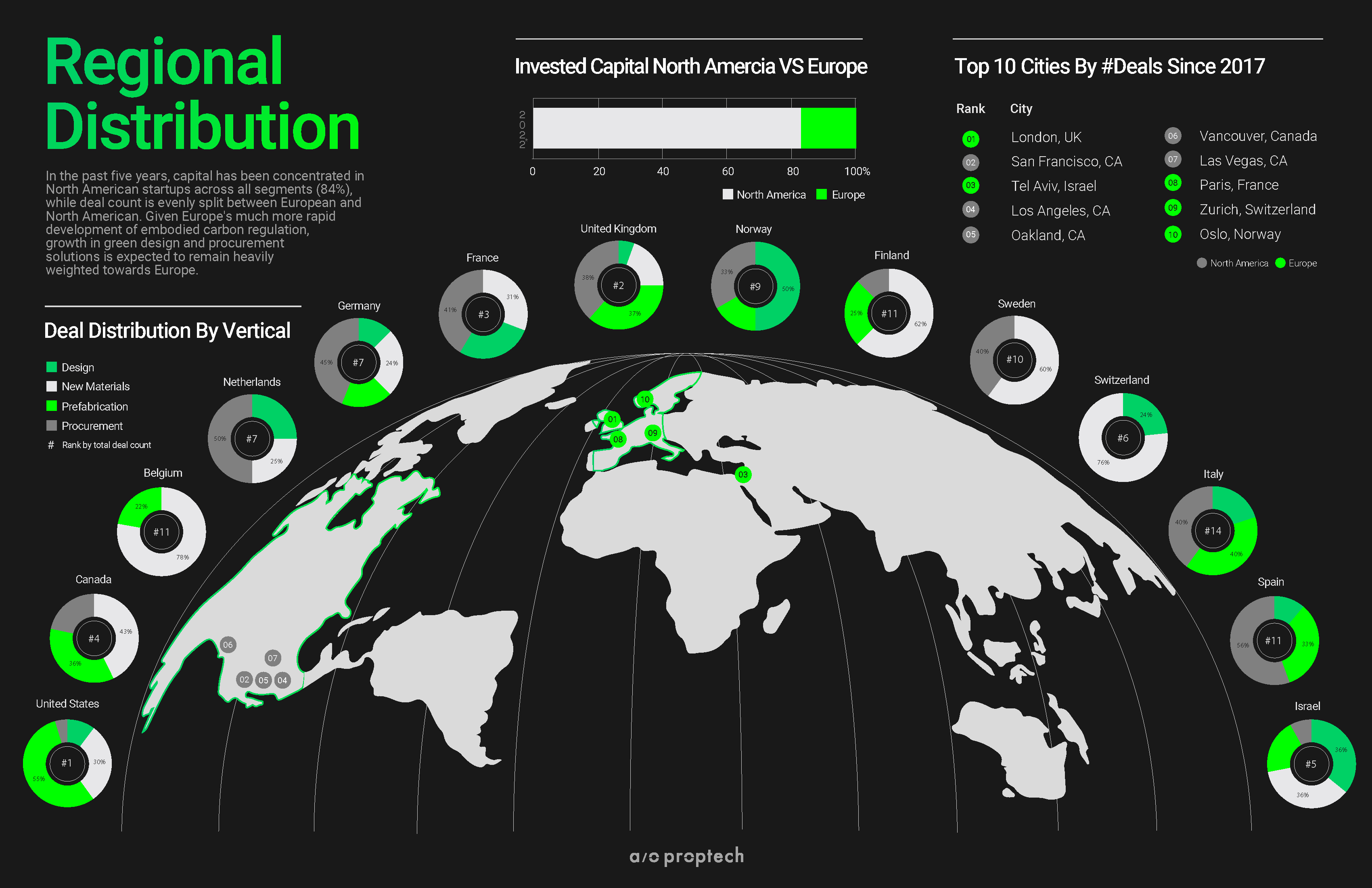

Which region of the world do you think will see the fastest growth in contech investments in the coming years?

Europe certainly has the most stringent regulations when it comes to green construction: for example France, Denmark, the Netherlands and Sweden have outlined carbon caps for new developments that will come into force by 2030. Reporting on lifecycle emissions and demonstrating meaningful reductions will require a level of digitisation currently missing in construction. For this reason, we expect to see significant adoption of construction technologies in European markets – both directly tackling carbon emissions – such as our portfolio companies Vizcab and 011h – and digitisation tools that serve as critical enablers of decarbonisation – such as our portfolio company Saqara.

We are also starting to see favourable regulations in the US market: for example, several states have introduced carbon caps on certain polluting materials, and the Inflation Reduction Act has allocated significant investment to both the development of the low-carbon building materials market and the formation of low carbon municipal building codes. This is creating a demand for Life Carbon Assessment (LCA) and material benchmarking solutions – such as Tangible Materials- that have been concentrated in the European market to date.

It’s important to note that while Europe currently has the most stringent embodied carbon regulation, the continent’s primary focus will be retrofitting existing building stock. New construction demand will instead be concentrated in the US and Asian markets. In the US, we have seen significant venture activity in prefabrication solutions – such as Veev, Juno, Plant Prefab. Solutions such as carbon-damaging concrete are highly nascent but long term could bear substantial potential for developing markets where construction processes are less formalised and even more fragmented.