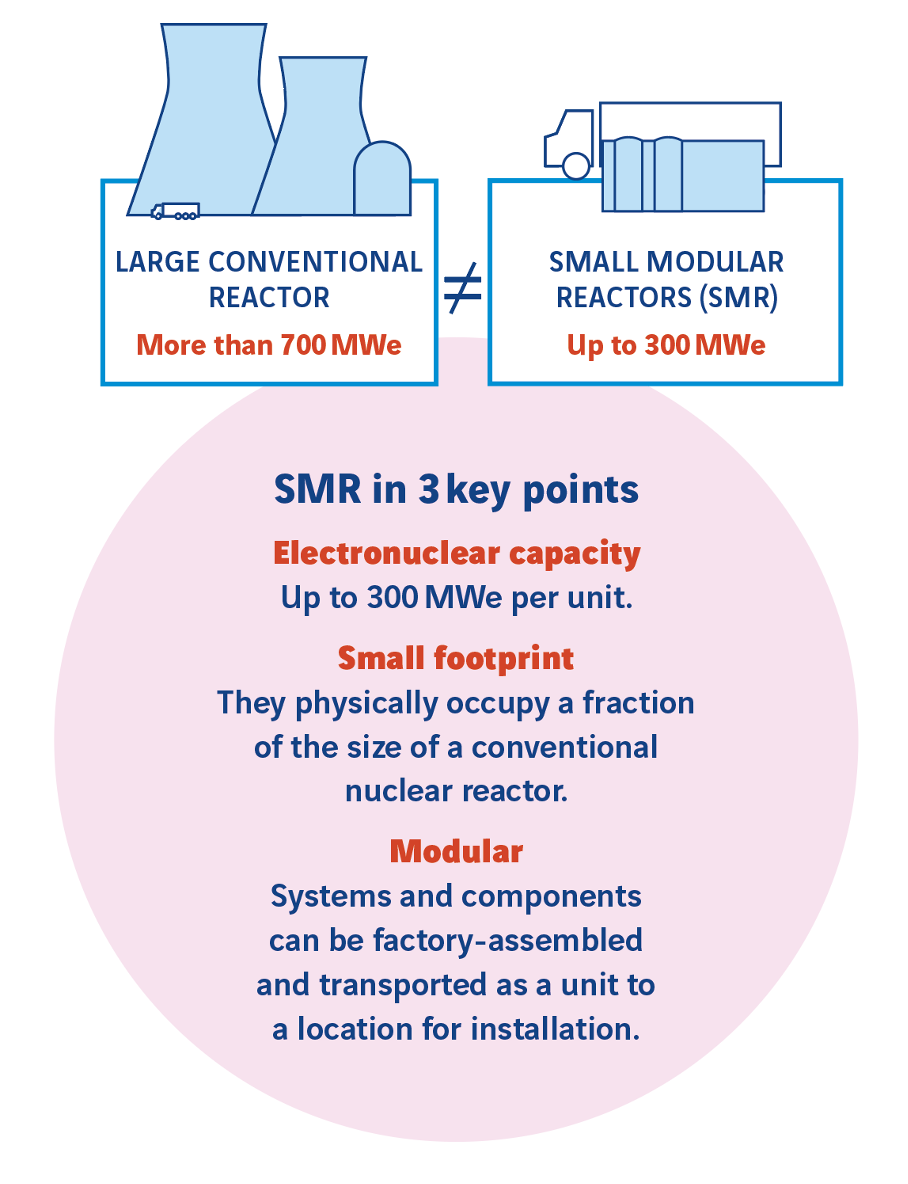

Small Modular Reactors (SMRs) can be installed on a reduced surface area (10 to 15 hectares compared to 100 to 300 hectares for a 900 MW nuclear power plant).

They benefit from innovations in passive safety, which reassures and makes it possible to consider installations near urban centres; SMRs produce between 50 and 300 MWe, but can operate in a modular network depending on demand.

They are prefabricated in factories, which reduces installation time (from 3 to 5 years compared to 10 to 15 years) and on-site installation costs; they produce electricity, of course, but also heat that can be used for industry or district heating networks. Finally, the energy produced by SMRs is decarbonised. These are all qualities that generate global interest in this technology, from both governments and private companies.

On the side of private companies

The tech giants are showing growing interest in SMRs due to their massive energy needs. Google has signed an agreement with Kairos Power to use SMR energy in its operations, particularly to power data centres and AI-related projects.

Amazon is investing to ensure a decarbonised and stable energy supply for its logistics and digital activities. Microsoft is actively exploring SMRs as part of its energy strategy to support its artificial intelligence ambitions and reduce its carbon footprint.

In 2023, the company signed an agreement to acquire nuclear energy through Constellation Energy, which aims to restart a unit at the Three Mile Island nuclear site, closed since 2019. This project could produce 835 MWe of energy by 2028.

On the side of governments

In the United States, the Department of Energy (DOE) announced a $900 million program to accelerate the deployment of Generation III+ SMR technologies. The United Kingdom sees SMRs as a key solution for achieving carbon neutrality by 2050: a government funding of £210 million has been allocated to support Rolls-Royce. The global market for SMRs is expected to reach $72.4 billion by 2033 (see opposite) and SMRs using advanced technologies like molten salt reactors.

Among other countries, Canada, which views this as an opportunity for the development of its remote regions and industrial activities, Russia (which has SMRs on floating platforms), China,

South Korea, Japan…

$ 72.4 billion

These are the findings of the latest report released by IDTechEx, titled Nuclear Small Modular Reactors (SMRs) 2023‑2043. It shows that the global SMR market is expected to reach $72.4 billion by 2033 and $295 billion by 2043, an annual growth rate of 30%.

NuScale

The small nuclear reactor project by the US company NuScale should be operational in 2030, with a 12-module power plant providing a combined output of 720 MW. The Department of Energy has granted NuScale around 1.4 billion dollars to develop this project, the most advanced in the United States.

This article is taken from our Yearbook 2025: “Shaping solutions”.

Read the yearbook 2025: « Shaping solutions »

Image credit: Dkosig Getty Image Signature