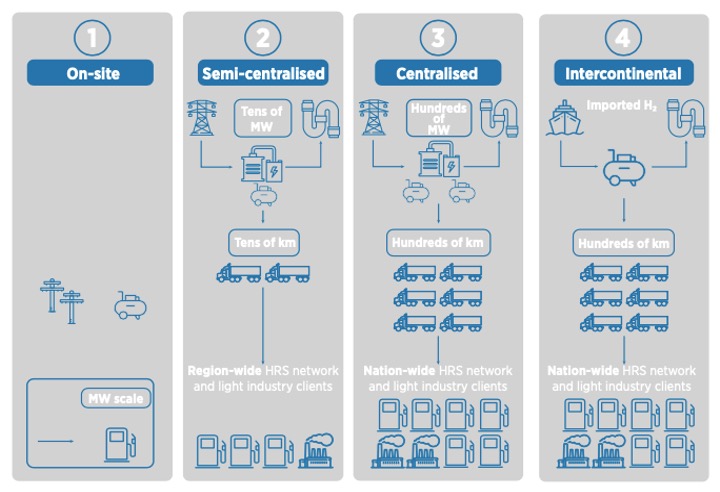

On-site vs. centralized production

On-site production of hydrogen enables proximity with end-uses, reduced storage, and little to no transport costs. This scheme is currently in place for industrial clients around the world, who benefit from continuous captive production. This model will continue to exist for mobility uses where territorial hubs are promoted in calls for tenders or where national production is important for national sovereignty, in France for example.

Regionally or nationally centralized production allows for gains from more competitive renewable energy sources as well as economies of scale, and is favored by gas industrials and the European Union. However, such a scheme can put production hundreds or thousands of kilometers from demand hubs, requiring dedicated hydrogen pipelines. Due to specific geographical features and energy policy choices, countries are also betting on an intercontinental exchange of hydrogen. As of today, Japan and Germany notably position themselves as net importers; Australia, Morocco, Chile as net exporters. As a result, transport and storage costs can amount to up to three times the cost of hydrogen itself.

> Source : Hydrogen: A renewable energy perspective, Report prepared for the 2nd Hydrogen Energy Ministerial Meeting in Tokyo, Japan, September 2019, International Renewable Energy Agency (IRENA)

Transporting H2 for short to medium distances

Under 400km, tube trailers containing up to 600kg of gaseous hydrogen at 150-250 bar are the most adopted option today, despite a cost of transport ranging from €0.5-€1.5 per kg H2. Liquid hydrogen trailers which can hold up to 4,000kg of H2 per shipment are less widespread and offer costs under €0.5 per kg H2.

Up to 1,500km, pipelines can offer a more competitive option, around €0.2-€0.3 per kg H2. However, technical and regulatory challenges could curb the current natural gas networks’ blending with H2 or complete reconversion into pure hydrogen pipelines. Hydrogen is three times less dense than CH4 and would require end-users to consume more gas to obtain the same energy. Additionally, networks have various blending tolerance limits, depending on country regulations: from 2-10% for long-distance transmission and up to 100% for some distribution networks. Constructing a new network dedicated to H2 transport is an alternative to retrofitting envisioned by the European Union and the European Backbone Project, while both will require a clear and enforced regulatory framework.

Transporting H2 between continents

Between continents, the retrofit or the construction of new hydrogen pipelines will lead to geopolitical challenges. This option is nonetheless considered by the EU and the European Backbone project, which see the Maghreb and Ukraine as possible trading partners.

Over 1,500km, maritime routes appear as safer and more cost-effective options. Gaseous hydrogen is not dense enough for such long distances, and alternatives are considered:

- Liquid hydrogen (LH2), which is 4-5x more energy dense than gaseous H2 (350 bars). However, hydrogen transforms from gas to liquid at -253°C, requiring high energy intensity for conversion and shipping: up to 30% of the initial hydrogen energy.

- Ammonia (NH3), which only requires 15 to 30% of the initial energy for conversion and reconversion, is already a tradeable asset and common industry feedstock. However, NH3 is toxic and could pose problems for shipping.

- Liquid Organic Hydrogen Carriers (LOHCs), molecules whose purpose is to transport H2 in liquid form at ambiant temperature. However, conversion also consumes 35%-40% of the initial energy.

Currently, all three solutions hike the price of hydrogen at port up 100-300%. This includes conversion and reconversion costs at €1 to €2 per kgH2 and shipping costs ranging from €0.3 to €1.2 per kgH2.

The need for buffer storage

Solutions exist to store H2 after production, as well as in passenger vehicles and trucks for hours or days, but present challenges. Pressurized at 700 bar, hydrogen tanks can hold a few kg of hydrogen and must be seven times bigger than gasoline tanks in cars and trucks. In buses or trains, tanks are pressurized at 350 bars, as volume is less of an issue. In the aviation sector, volume will prove one of the most challenging issues to solve, leading the tank of the future H2 powered aircraft as one of the most critical components to design.

Buffer storage at maritime hubs for hours or days prior to shipping, and inter-seasonal storage (hydrogen can be stored for months without losing power) call for new needs. Turning to VINCI Geostock’s expertise in the oil and gas industry, solutions which offer hundreds of times tanks’ capacity can be found:

- Salt-leached caverns, where hydrogen can be stored for €0.3-€0.6 per kg for 30 years. Developed since the 1970s in the UK and the 1980s in the US, commercial underground caverns can hold 4,000 tons of gaseous hydrogen, and up to a theoretical 20,000 tons.

- Porous aquifers or depleted oil or gas fields are yet-to-be-proven alternatives, which could offer a new life to passive assets. However, one should keep in mind that porous aquifers or depleted fields have been used in the past for “town gas”, which could contain up to 50% of hydrogen.

- Mined rock caverns are another option currently exploited for oil and gas which could be adapted to hydrogen storage. This will require some R&D effort to develop an appropriate liner.

Multiple innovations are emerging to address storage challenges

New fuel cells which can be fed NH3 instead of pure H2 could ease intercontinental transport. Cheaper separation technologies for gas from blended pipelines would increase the pace of adapting the network. A hydrogen “powerpaste” with 10x the energy density of batteries developed by the Fraunhofer Institute paves the way for new mobility applications. Without the need for large tanks, drones and scooters could benefit from extended ranges. All three innovations show that disruption will play a key role in the years to come.

In the end however, pipeline transport will most likely be driven by the adoption and enforcement of new regulations, allowing for them to become a regulated asset like existing CH4 pipes. The agenda of the incumbent gas industry and of major hydrogen projects such as HyDeal will also shape developments. For maritime transport, technology standardization and eventual commodification would give the market better price signals and foster increased industrial adoption.

Read also!

> Low-carbon production of hydrogen